- President Javier Milei of Argentina endorsed a new cryptocurrency called “$LIBRA,” presenting it as a solution for small and medium-sized enterprises in the country.

- The cryptocurrency initially surged to $5,000, but quickly collapsed to 99 cents, leading to public outrage and legal actions against Milei.

- Milei is accused of a “rug pull” scheme, where a project’s creators abandon it after inflating its price and cashing out.

- Amidst the backlash, Milei removed his promotional posts and claimed limited knowledge of the initiative, despite alleged prior associations with its creators.

- The incident has prompted calls for Milei’s impeachment and highlighted the crucial need for transparency in both politics and financial ventures.

- The saga serves as a reminder of the perils of chasing quick financial gains without adequate due diligence.

A whirlwind of chaos swept through Argentina’s digital landscape as President Javier Milei’s recent endorsement of a cryptocurrency spiraled into controversy. On February 14th, Milei took to social media, enthusiastically championing a new crypto venture named “$LIBRA.” The president heralded it as a beacon of hope for the country’s struggling small and medium-sized enterprises, suggesting that investments would invigorate these vital economic engines.

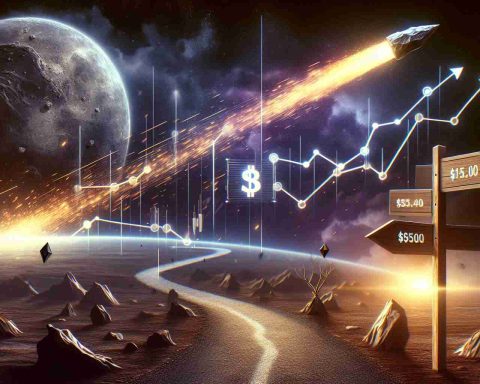

But what seemed like a strategic innovation soon turned murky. The virtual coin initially soared, reaching nearly $5,000, igniting investor excitement across the nation. However, the euphoria was short-lived. Just as swiftly, “$LIBRA” plummeted to a mere 99 cents, leaving a trail of bewilderment and despair. The jarring drop stirred public outrage and led to a collective lawsuit against Milei, accusing him of orchestrating a “rug pull” — a deceitful tactic where creators abandon a project after driving prices up, cashing out at investors’ expense.

Amid the growing uproar, the President retracted his posts and distanced himself from the embroiled investment, claiming unfamiliarity with the specifics of the venture. Nevertheless, whispers of prior meetings with the crypto’s architects surfaced, casting shadows on his claims.

The scandal has rumbled into the political realm, as opposition legislators call for impeachment, citing the adverse global headlines it has sparked. As the narrative unfolds, it underscores a singular truth: the allure of quick gains can eclipse due diligence, reminding us that in both politics and finance, transparency is paramount.

Is President Milei’s Cryptocurrency Endorsement the Next Big Scandal?

How-To Steps & Life Hacks: Navigating Cryptocurrency Safely

1. Conduct Thorough Research: Before investing, research the cryptocurrency’s white papers, creator’s backgrounds, and market history.

2. Evaluate Legitimacy: Look for red flags that suggest a rug pull, such as anonymous creators, promised unrealistic returns, or lack of transparency.

3. Use Reliable Platforms: Stick to well-known exchanges and never invest more than you can afford to lose.

4. Diversify Investments: Avoid putting all your investments in one asset; diversification helps mitigate risks.

5. Stay Informed: Follow credible sources and communities for the latest updates and expert analyses in the crypto world.

Real-World Use Cases

Cryptocurrencies have been utilized beyond speculation, including:

– Cross-Border Transactions: Cryptos often serve in international remittances, making transfers faster and cheaper.

– Smart Contracts: Ethereum and alike allow the execution of smart contracts, facilitating automated agreements.

– Tokenization of Assets: Real estate and art are examples where tokens represent physical assets, providing fractional ownership.

Market Forecasts & Industry Trends

Cryptocurrency remains volatile but is projected to grow, with increasing mainstream adoption. According to a Grand View Research, the global cryptocurrency market size was valued at USD 1.49 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 12.8% from 2021 to 2030.

Reviews & Comparisons

A comparative analysis between $LIBRA and established cryptocurrencies like Bitcoin and Ethereum highlights:

– Stability: Bitcoin and Ethereum, though volatile, have robust networks and extensive adoption.

– Innovation: $LIBRA’s claims of aiding SMEs seemed promising but lacked the foundation upon sudden value collapse.

– Security: Established cryptos offer better security protocols compared to lesser-known options.

Controversies & Limitations

Cryptocurrencies face increasing scrutiny over:

– Environmental Impact: Bitcoin’s energy consumption has drawn criticism, though newer coins are exploring sustainable solutions.

– Regulatory Uncertainty: Legal complications as governments worldwide implement varying degrees of regulation.

Features, Specs & Pricing

While specific specs are unknown for $LIBRA, typical cryptocurrencies focus on:

– Decentralization: Ensuring no single entity has control.

– Consensus Mechanism: Methods like proof-of-work or proof-of-stake that validate transactions.

– Supply Cap: Coins often have a fixed supply to prevent inflation.

Security & Sustainability

– Security: Opt for wallets that implement multi-factor authentication and other security measures.

– Sustainability: Look into cryptos adopting proof-of-stake, which is more energy-efficient than proof-of-work.

Pros & Cons Overview

Pros:

– High potential returns.

– Innovative technological applications (smart contracts).

Cons:

– High volatility.

– Regulatory and legal uncertainties.

– Risk of scams and frauds.

Actionable Recommendations

– Always perform diligence when evaluating investment opportunities.

– Engage with local financial advisors for personalized advice.

– Stay updated with regulations and adopt holistic approaches when dealing with digital assets.

Cryptocurrency presents both opportunities and challenges. Ensure informed decisions are based on a strong foundation of research and risk assessment. For more insights on the financial market, visit Forbes or Bloomberg.