The People’s Bank of China (PBOC) has unveiled an ambitious funding initiative valued at ¥500 billion (approximately $70.6 billion) aimed at revitalizing the nation’s stock markets. This funding program will enable financial entities such as brokerage firms, mutual funds, and insurance companies to enhance their liquidity positions by using existing assets as collateral for new investments.

Under this innovative scheme, various types of collateral, including bonds and exchange-traded funds linked to the CSI 300 Index, can be utilized to secure liquid financial instruments like treasury bonds and bills issued by the central bank. PBOC officials have indicated that the initiative could expand with additional funding rounds if the initial phase shows promise.

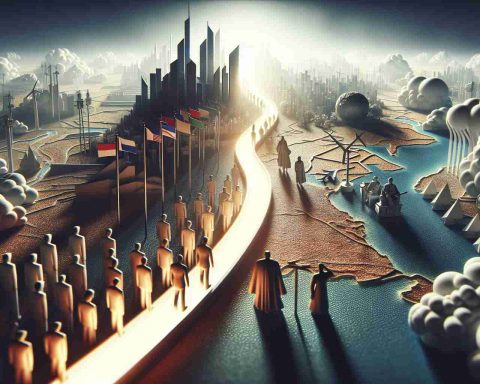

This proactive move follows a period of significant downturns in the Chinese equity markets and is aimed at restoring investor confidence amidst existing economic uncertainties. Alongside this, the central bank announced additional monetary easing measures such as reducing the required reserve ratios and lowering interest rates on reverse repos.

The announcement sparked a positive reaction in the stock market, contributing to significant gains in several indices. Additionally, the cryptocurrency market experienced shifts following the news, with Bitcoin’s fluctuations closely linked to these developments. Analysts predict that ongoing economic interventions could lead to favorable outcomes for both traditional and digital assets, setting the stage for potential growth in the market landscape.

China’s Central Bank Unveils Major Funding Initiative to Support Financial Markets

In a decisive move to stabilize and invigorate the Chinese financial landscape, the People’s Bank of China (PBOC) has launched a ¥500 billion (approximately $70.6 billion) funding initiative aimed at boosting liquidity in financial markets. This initiative is designed to allow various financial institutions—including brokerage firms, mutual funds, and insurance companies—to leverage their existing assets as collateral for new investments. This proactive approach comes in response to a series of downturns in the equity markets, a situation exacerbated by lingering economic uncertainties.

Key Questions and Answers:

1. What are the goals of the funding initiative?

The primary objectives are to enhance liquidity among financial institutions, restore investor confidence, and stabilize the stock markets by addressing the systemic issues impacting financial resources.

2. How will the collateral system work?

Financial entities can use a range of assets, including bonds and ETFs linked to the CSI 300 Index, to secure liquid instruments like treasury bonds and central bank bills, boosting their capacity for new investments.

3. What are the expected outcomes of this initiative?

The initiative aims to revitalize investor sentiment, support market stability, and create a foundation for sustained economic recovery. Furthermore, expansion of the program could be considered if the initial results are favorable.

Key Challenges and Controversies:

One of the main challenges associated with this initiative is the potential for moral hazard, where institutions may take on excessive risk due to the availability of funding. Additionally, concerns about ongoing economic slowdowns, continued uncertainty in real estate markets, and geopolitical tensions could undermine the initiative’s effectiveness. Critics also raise questions about whether this funding approach sufficiently addresses deeper structural issues within the Chinese economy.

Advantages and Disadvantages:

Advantages:

– The initiative increases liquidity, which can help stabilize financial markets.

– It can restore investor confidence and potentially stimulate new investments.

– The use of a diverse set of collateral types may increase participation from various financial entities.

Disadvantages:

– There is a risk of creating reliance on central bank supports, leading institutions to engage in riskier behavior.

– If the underlying economic issues are not addressed, the effects may be temporary.

– Potential inflationary pressures could arise from the increased monetary supply if not carefully monitored.

Conclusion:

This bold move by the PBOC marks a significant step in addressing the challenges facing China’s financial markets. As the situation evolves, stakeholders will be closely monitoring the effectiveness of this initiative and its ramifications on both domestic and global markets.

For more information on the topic, visit the main domain of the People’s Bank of China at PBOC official website and follow up with developments that may impact financial institutions and investors alike.